Hello everyone,

Farrukh Kazmi

We hope that everyone is keeping safe and healthy. With the Presidential Election around the corner, there is a large amount of discussion surrounding potential outcomes and impacts. It is fair to say that this election cycle is unique in many respects, and with starkly contrasting politics there has been no shortage of news to digest. As the saying goes, “Elections have consequences.” However, that does not necessarily translate to meaningful long-term impacts on markets.

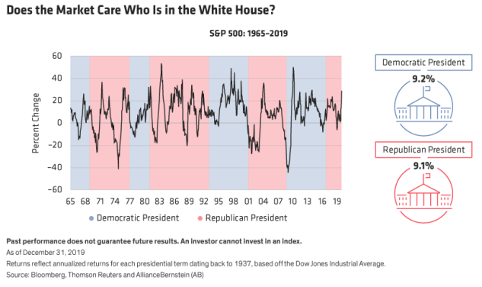

Looking at the past, political party control of the White House has had marginal effect on markets over the long term. Regardless of the political noise of crediting or blaming various administrations, a look at the chart below suggests long-term market returns have been historically apolitical, with the DOW returning similar results no matter who is in office.

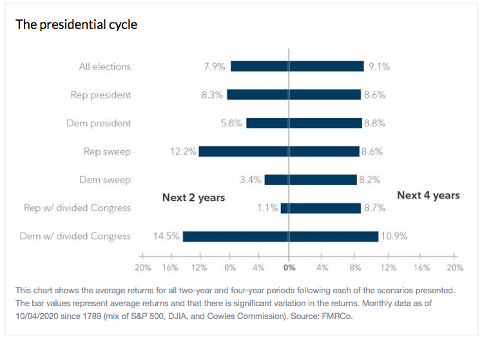

Although there are varying elements of influence, markets overall tend to be resilient to such external factors, including control of Congress. A breakdown of post-election history below shows that, on average over the course of a full term, markets again are somewhat neutral with regard to party affiliations.

By Farrukh Kazmi

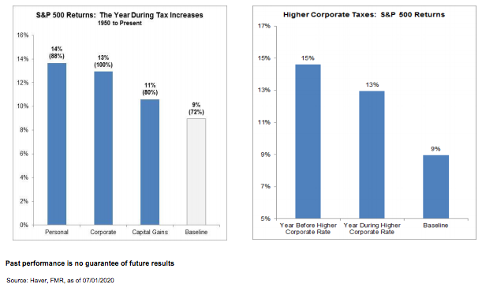

Like many general elections, there are usually intensely contrasting policy stances. Another factor that is frequently talked about is concern over potential market impact of tax policy changes. Contrary to some popular mantras, the chart below illustrates that strong equity markets can in fact occur in the years surrounding tax increases.

Of course, past performance does not guarantee future results, and there are several elements and policies to consider that could affect markets. With such an intensely contested election cycle and the accompanied uncertainty, short-term volatility could be expected. After the election is settled, the focus may likely once again shift back to fundamentals of the economy, including pandemic recovery data and ongoing stimulus potential.

As we’ve shown that elections and policy outcomes can have uncertain impacts, we would urge our clients to not let politics be the sole dictator of their investing strategy, and to continue to have a diligent approach with our team to manage assets. Regardless of the results of the 2020 Election, we are here to help you through this next phase of the market cycle.

Please stay safe and healthy, and feel free to reach out to us should you need to make any adjustments or even just to chat.

Sincerely,

Farrukh Kazmi

Financial Advisor

https://institutional.fidelity.com/app/literature/view?itemCode=9900313&renditionType=pdf&pos=A

https://institutional.fidelity.com/app/item/RD_9899127/the-election-covid-and-markets.html?pos=A

https://www.alliancebernstein.com/library/Do-US-Elections-Matter-for-Equity-Investors.htm

Farrukh Kazmi

A & S Asset Management

1714 Memphis Street

Suite 110

Philadelphia, PA 19125

Farrukh Kazmi

Office: (856) 437-3215

Fax: (856) 437-3215

Mobile: (856) 630-0691

Registered representative of and securities offered through Berthel Fisher and Company Financial Services, Inc. (BFCFS). Member FINRA/SIPC. Investment advisory services offered through BFC Planning, Inc. A&S Asset Management, BFCFS, and BFC Planning, Inc. are independent entities. Please note electronic mail is not secure: Berthel Fisher & Company does not accept or take responsibility for acting on time-sensitive instructions sent by email.

Our firm does not provide legal or tax advice. Be sure to consult with your own legal and tax advisors before taking any action that may have tax implications.

The interpretations and organization of these ideas are the confidential thoughts of A&S Asset Management and do not represent the opinions of Berthel Fisher & Co. Financial Services, Inc. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please note that forward-looking statements do not ensure that the stated forecasts will come to pass. Please consult your Financial Representative for further information.

This material contains confidential information intended only for use of the

individual or entity named. It has been determined that the intended

recipient meets the financial criteria to act upon this material. If you are

not the intended recipient, you are hereby notified that any dissemination,

distribution or copy of this transmission is strictly prohibited. If you

receive this communication in error, please immediately notify the sender.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

A&S Asset Management, BFC Planning, Inc., and BFCFS does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. A&S Asset Management, BFC Planning, Inc., and BFCFS cannot guarantee that the information herein is accurate, complete, or timely. A&S Asset Management, BFC Planning, Inc., and BFCFS makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.